Gross Profit Margins – Where it all begins

For service or contacting businesses the first important financial KPI is gross margin. Why? Because everything starts here.

That determines:

- How effectively you are pricing your services

- Determines the cash flow to support operational expenses

- Sets up your income distributions

In this review, we will talk about what gross margins are, why gross margins matter, and how to improve them if you are not where they should be.

What are Gross Margins?

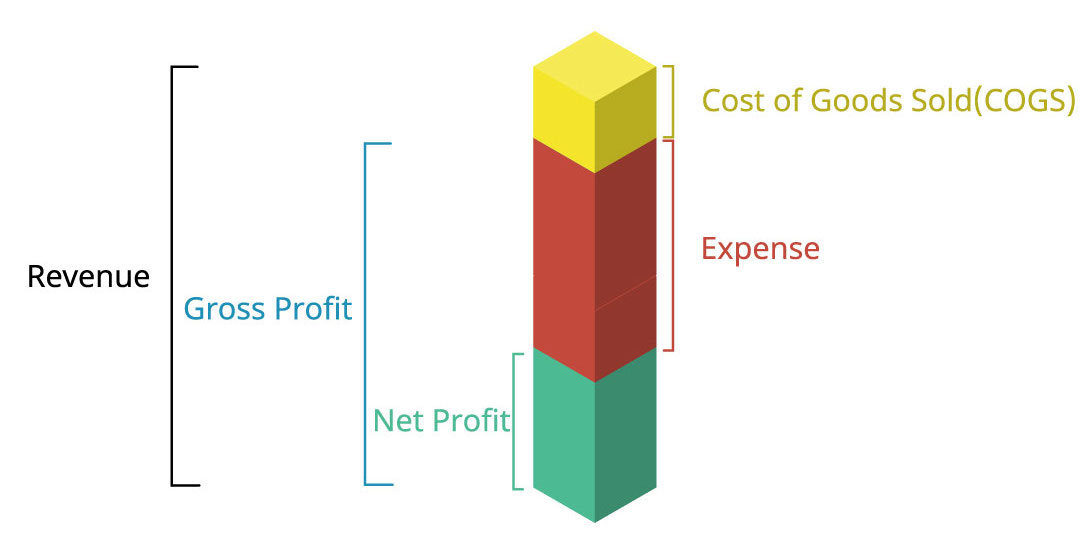

Gross margins represent the percentage of revenue that remains after you subtract the cost of goods sold (COGS). COGS, also known as direct costs include:

Materials

Parts

Equipment

Labor

Gross margins are calculated by subtracting these costs from the total revenue generated by a business. In other words, you add up all the money your company has made from sales and subtract your production costs.

Cost of goods sold (COGS) are different from the operating cost. Operating costs are advertising, marketing, sales, rent, utilities, office supplies, legal, accounting, and bookkeeping. These come out of gross profit to determine net income.

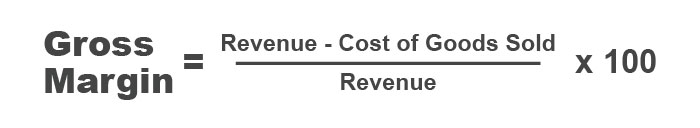

Keep in mind, gross margins are usually presented as a percentage, so you should divide the gross profit by your overall revenue to determine your gross margin percentage (see the example below).

Gross Margins for service businesses should be 45% (or greater) and for contracting businesses 35% (or greater).

Why Do Gross Margins Matter?

It tells you how you are pricing relative to production cost and it gives you the cash flow to cover operating cost including back office, sales and marketing.

Gross margins allow you to make informed decisions about how to improve your business operations and maximize your company’s profitability and long-term outlook; gross margins also play a key role in understanding how to value a business. For potential buyers, gross margins are a key indicator of the current and future success of your company.

Notably, the primary reason gross margins matter is because it signals profitability. In other words, it tells you if your prices are too low, your costs too high, or both.

Profitability

Non-financial considerations matter to potential buyers, but at the end of the day, they are primarily concerned with how profitable your company is and can be in the future. Gross margins are a key indicator of your company’s profitability. Notably, it may reveal one of several possible scenarios:

- Your prices are too low – If your gross margin is less than ideal and there is not much room to lower your operating expenses, then it is likely time to raise your prices.

- Your operating expenses are too high – If you are charging competitive rates but your gross margin is less than ideal due to high operating costs, then it is best to find ways to lower your cost to operate.

- Your prices are too high – In some cases, your prices may be too high, particularly if your sales numbers are not where they should be but your gross margin is excellent. For example, if your gross margin is at 60% but you are not generating enough sales, then it may be beneficial to lower prices and reduce your gross margin in an effort to create more sales in the short term.

This third item might seem odd. You might say how can my prices be too high?

Sellers also want to see revenue growth at 20%+ per year. So, if prices are too high this might be limiting what the annual growth rate of the business is. It is a delicate but important balance.

Our experienced business advisors know how to value a business and will help sell your business.

What Should I Do if My Gross Margins Are Low?

Three Options

You have three options if your gross margins are not where they need to be.

1. Sell your company outright for a swift exit

If you are wanting to sell your business today then “it is what it is”. Let’s determine the valuation, find a buyer and move on.

2. Merge with a private equity (PE) firm or consolidator within your industry

Larger companies are able to purchase materials in larger quantities and retain employees better, which significantly reduces operating costs and improves gross margin percentages. It also gives you money from a partial sale while still providing you the freedom to build your company further and sell the rest in a 5 to 7 year timeframe.

3. Improve gross margins entirely on your own

You may be able to improve your gross margins without a merger, depending on the cause of the low gross margins. In this case, you can improve your company’s earnings and long-term outlook, which raises your value and allows you to sell for more once you are ready.

How to Improve Gross Margins

Improving your gross margins involves a detailed evaluation of your company’s operations, pricing methods, material costs, and more. Here are five concise strategies to enhance gross margins:

- Supplier Cost Reduction: Negotiate better terms and explore alternative suppliers to reduce material costs.

- Strategic Pricing: Implement more strategic pricing methods. For example, gradually increase prices to maintain profitability without alienating customers.

- Improved Technician Productivity: Invest in training and technology to maximize technician productivity

- Service Offerings: Expand your service offerings to create opportunities for multiple sales during a single customer visit.

- Maintenance Contracts: Focus on your maintenance contracts with automatic renewals, which helps ensure a consistent revenue stream.

Gross Margin FAQs From a Business Broker

How is gross margin different from net profit?

Gross margin represents your company’s profitability after you deduct direct costs, such as the costs for materials and labor. It does not, however, subtract all costs your business may have. For example, your company may have indirect costs that are not factored in with gross margin, such as taxes and licensing fees.

Your net profit (or net margin) factors in indirect costs and represents your company’s actual profit, whereas gross margin focuses solely on direct operating costs and sales numbers.

What is an example of gross margin?

Let’s say you operate an HVAC company that generates $10 million in annual revenue. Let’s also say that their cost of goods sold (COGS) is $6 million.

To calculate gross margin in this example, you will do the following:

Gross Margin = ((Revenue – Cost of Goods Sold) / Revenue) x 100

Gross Margin = (($10,000,000 – $6,000,000) / Revenue) x 100

Gross Margin = ($4,000,000 / $10,000,000) x 100

Gross Margin = 40%

Remember, gross margin is usually presented as a percentage. In this case, the HVAC company would profit 40% of every dollar they generate. In other words, for every dollar they spend, they generate $1.40.To calculate gross margin in this example, you will do the following:

Receive a Free Business Assessment

Contact Brentwood Growth

The first step to selling your business is determining its worth. Our business advisors help you price your company, determine when to sell, and answer all of your questions

Contact Brentwood Growth today to receive a complimentary business assessment from our experienced business brokers.